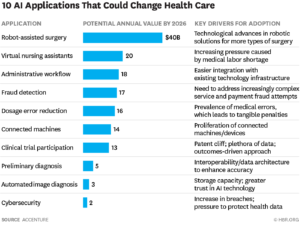

Advancements in AI technology have the potential to enable $150 billion in annual savings for the healthcare market by 2026 in just the US alone, according to a 2017 market report by Accenture, explain Yoram Kraus Co-Founder & CEO – infi. Growth in the AI health market is expected to reach $6.6 billion by 2021—a CAGR of 40 percent. In the next five years, the health AI market is projected to grow more than 10x.

The value and potential of AI in healthcare is almost limitless. AI technology has the unprecedented ability to drive major efficiencies through streamlining and automating administrative processes, as well as supporting the performance of complex surgeries and aiding in clinical interventions. So much new, game-changing technology is already readily available, yet healthcare providers are notoriously slow to adopt and integrate the cutting-edge AI technology already in the market. In fact, the healthcare industry lags behind nearly every other industry in terms of the speed with which they adopt new technologies.

Reasons behind this glacial pace include financial constraints (either because of the costs of new technologies or because they reduce doctor/hospital visits which, depending on the market and the nature of conditions being treated, may be a disincentive for healthcare providers), the time it takes to teach new technologies to overburdened medical professionals (as well as additional work doctors may need to add to their already heavy load, for example entering data manually if the new technology being introduced is not 100% automated), as well as the instinctive aversion many medical professionals feel towards new measures that ostensibly reduce lessen human interaction.

However, the bottom line is that those who move quickly to adopt new AI technology will be rewarded. The aforementioned Accenture report breaks down the near-term fiscal impact of the widespread adoption of major AI applications and it’s significant. The top three applications that represent the greatest near-term value are robot-assisted surgery ($40 billion), virtual nursing assistants ($20 billion) and administrative workflow assistance ($18 billion).

The star of the show is cognitive robotics

Cognitive robotics are pioneering new approaches to surgical interventions by assisting in operating instrument precision, blending man and machine in their effort to enhance the accuracy and efficiency of surgery. Notably, the inventors of the Smart Tissue Autonomous Robot (STAR) showcased at the IROS 2017 robotics conference experiments they conducted with comparing the results of interventions aided by their technology and the cutting precision of a human surgeon. The experiments showed that their machinery makes more precise cuts than expert surgeons, and damages less of the surrounding flesh. Similarly, in 2016, the STAR system sewed together two segments of pig intestine with stitches that were more regular and leak-resistant than those of experienced surgeons.

Meanwhile, in orthopedic surgery, AI robotics have advanced enough to be able to analyze data from pre-op medical records to physically guide the surgeon’s instrument in real-time. This kind of AI-assisted robotic surgery in orthopaedics is predicted by some research to generate a 21% reduction in patients’ length of stay in the hospital following surgery, creating $40 billion in annual savings.

Virtual assistants, a game-changing close second

Virtual nursing assistants are listed second in the Accenture report in terms of AI healthcare products with near-term value. The report projects virtual health assistants will enable $20 Billion in potential savings to the industry by enabling off-site monitoring and care, through which healthcare providers are able to minimize unnecessary hospital visits and save 20 percent of registered nurse time.

Crucially, this number refers to standard virtual nursing assistants that are not powered by EmpathAI unlike infibond’s Medical Concierge, meaning they are limited in their ability to provide a personalized and customized experience on par with the abilities of human doctors. Infibond’s Medical Concierge uses sophisticated Deep Psychology to power machine learning, which enables our hyper-realistic virtual surrogate doctors to get to know the precise traits, internal motivators and real-time emotional states of each individual user. In so doing, the Medical Concierge is expertly equipped to offer hyper-personalized recommendations, understand how to speak to each user in a way that will best motivate them to improve their self-care, and understand from real-time monitoring the exact lifestyle issues that may be impeding recovery. The nature of machine learning means that over time our Medical Concierge is only going to increase in accuracy and effectiveness as they get to know each patient and their respective personalities, lifestyles and bodies better and better. The result? An up to 80% estimated decrease in unnecessary hospitalizations and admissions.

About Yoram Kraus

Yoram Kraus, Infibond I Co-Founder & CEO

Yoram Kraus is a serial entrepreneur, with several investments in high tech over the past decade. He has more than 20 years of entrepreneurship in real estate & global engineering projects, and is the founder of the second-largest REIT fund in Israel. He has a degree in Civil Engineering from the Technion-Israel Institute of Technology, he served as an intelligence officer in the IDF special forces and is a keen mountaineer and extreme sportsman.

Jacob

Latest posts by Jacob (see all)

- Why I Ditched Google for PrivacyWall and You Should Too - April 13, 2021

- 7 Reasons Why Privacy is Critical in Coin Collecting Software - September 22, 2020

- Andrew Anastasiou Launches LegionPay - August 13, 2020