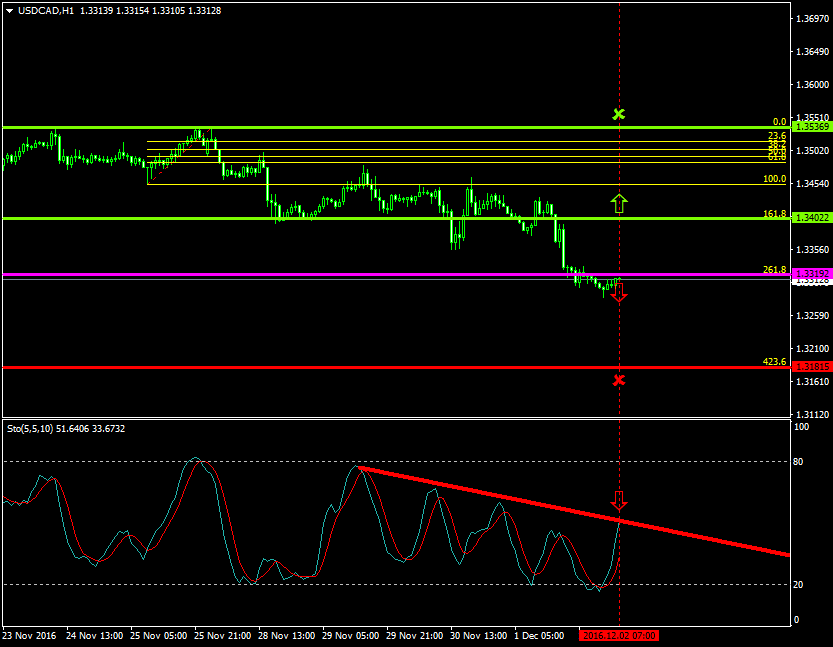

What’s next on the USDCAD at the 1.3319 zone?

The USDCAD pair has been, since the 25th of November 2016, oscillating within a bearish formation from 1.3536 to 1.3319. Will the sellers resume leading the price?

Today’s major pivot point area is the 1.3319 level where the sellers will likely take their chances to resume leading the price to their favour.

Probable Scenario

The latest stabilization of the pair close to the 1.3319 level is a good indication that the sellers may exert greater pressures to force the price to the downside.

The Stochastic oscillator has also confirmed that the price could aggressively drop at the 50 zone.

In the scenario where the pair decelerates, the price could fall to 1.3181.

Alternative Scenario

Alternatively, in the event where the sellers are not able to hold the price close to the 1.3402 area, and the buyers place greater pressures, the pair could rise back to 1.3536.

Today’s Major Announcements

- U.S.’s Unemployment Rate (Nov), the Labor Force Participation Rate (Nov), and the Nonfarm payrolls (Nov) announcements could have a strong impact on the U.S. dollar

- The Unemployment Rate (Oct), the participation Rate (Oct) and the Net Change in Employment (Oct) releases could have a medium impact on the Canadian dollar

Synopsis

· Probable trend (Bearish): 1.3319

· Bearish take profit target: 1.3181

· Stop loss target: 1.3402

· Alternative trend (Bullish): 1.3402

· Bullish take profit target: 1.3536

Elias Kazamias

Latest posts by Elias Kazamias (see all)

- Foobee Launch Captures Public Imagination - July 10, 2021

- NoBanx Launches in Cyprus - April 28, 2021

- How to Choose the Best Forex Broker? - November 7, 2020