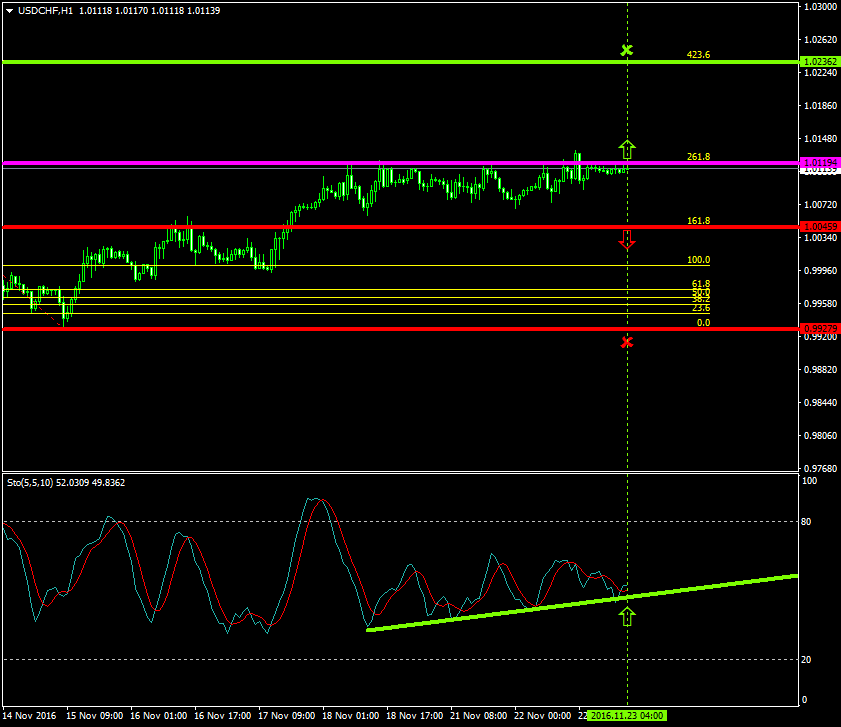

Will the pair break above the 1.0119 level on the USDCHF?

The bullish pressures on the USDCHF got more tensed since the 15th of November 2016 where the price climbed from 0.9927 to 1.0119.

Today’s major pivot point area, the 1.0119 zone, is a critical level for the buyers in their attempts of boosting the price once again to the upside.

Probable Scenario

The latest stabilization of the price close to the 1.0119 level is a good indication that the bulls could likely exert momentum to lead the pair upwards.

Stochastic oscillators’ formation signals that a probable bullish retracement at the 50 level has greater probabilities to occur.

In the event where the pair appreciates, the buyers could set their take profit target at 1.0236.

Alternative Scenario

Alternatively, a bearish break-out at the 1.0045 zone could signal that the sellers may exert far greater pressures to force the price to lower areas such as the 0.9927 level.

Today’s Major Announcements

- The Durable Goods Orders (Oct), the Durable Goods Orders ex Transportation (Oct), the EIA Crude Oil Stocks Change (Nov 18), and the FOMC Minutes releases are expected to have a strong influence on the U.S. dollar

- There are no any releases on the Swiss franc

Synopsis

· Probable trend (Bullish): 1.0119

· Bullish take profit target: 1.0236

· Stop loss target: 1.0045

· Alternative trend (Bearish): 1.0045

· Bearish take profit target: 0.9927

Elias Kazamias

Latest posts by Elias Kazamias (see all)

- Foobee Launch Captures Public Imagination - July 10, 2021

- NoBanx Launches in Cyprus - April 28, 2021

- How to Choose the Best Forex Broker? - November 7, 2020