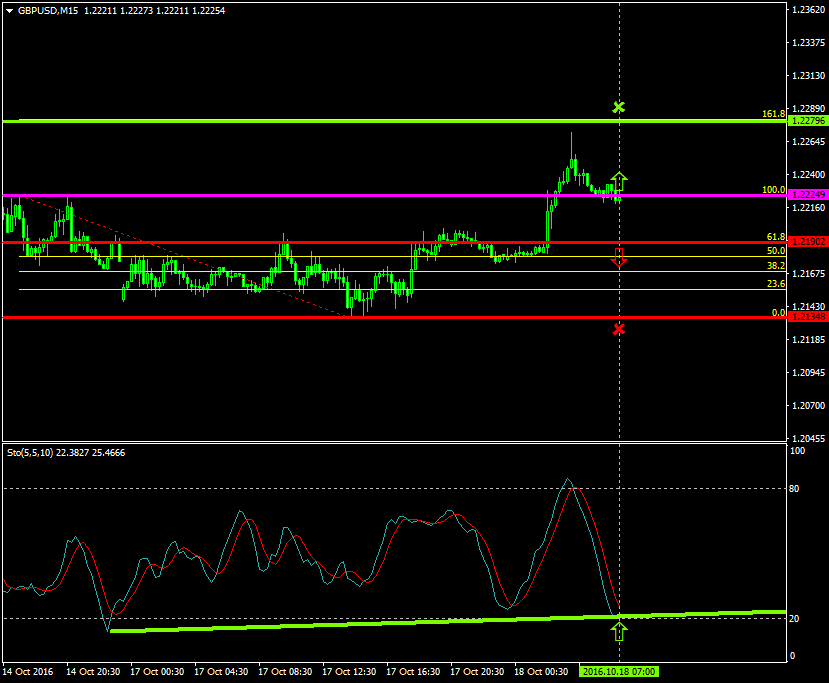

Will the buyers lead the GBPUSD at 1.2224?

The GBPUSD after escalating from as low as 1.2134 to as high as 1.2265 has now stabilized close to today’s major pivot point area the 1.2224 level.

Stochastic oscillator’s latest formation shows a pattern of a steady appreciation at the 20 level where the pair is expected to retrace once again to the upside.

Probable Scenario

In the condition where the pair stabilizes above the 1.2224 level and the upside pressures somehow get more tensed, the price could rise to the 1.2279.

The buyers therefore have greater probabilities of taking control on the pair and resume their upside pressures since the 17th of October 2016.

Alternative Scenario

Alternatively, in the event where the bearish pressures force the pair below the 1.2190 zone, the price could drop to 1.2134.

Today’s Major Announcements

- The Consumer Price Index (YoY) (Sep) and the Core Consumer Price Index (YoY) (Sep) releases are expected to have a strong influence on the sterling

- The Consumer Price Index Core s.a. (Sep), the Consumer Price Index n.s.a (MoM) (Sep), the Consumer Price Index (MoM) (Sep), the Consumer Price Index Ex Food & Energy (MoM) (Sep), the Consumer Price Index Ex Food & Energy (YoY) (Sep), the Consumer Price Index (YoY) (Sep), and the NAHB Housing Market Index (Oct) releases are expected to have a medium influence on the U.S. dollar

Synopsis

· Probable trend (Bullish): 1.2224

· Bullish take profit target: 1.2279

· Stop loss target: 1.2190

· Alternative trend (Bearish): 1.2190

· Bearish take profit target: 1.2134

Ben Myers

Latest posts by Ben Myers (see all)

- 3 Reasons Bitcoin is Still a Safe Haven Asset - June 12, 2020

- GCF Corporation and Genesis Green Initiatives Leading the Way - May 20, 2020

- Why Bitcoin Still Rules the Roost - May 13, 2020